Practice Areas

“Great things are not done by impulse, but by a series of small things brought together.” ― Vincent Van Gogh

Business Entity Selection and Formation Services

The business structure you choose influences everything from day-to-day operations, to taxes, to how much of your personal assets are at risk. You should choose a business structure that gives you the right balance of legal protections and benefits.

Special Needs Planning

If you want to leave money or property to a loved one with a disability, you must plan carefully. Otherwise, you could jeopardize your loved one's ability to receive Supplemental Security Income (SSI) and Medicaid benefits. A "special needs trust" can avoid some of these problems.

Buy Sell Agreements and

Business Succession Planning

provides a mechanism for an orderly business succession should an owner decide to transfer his interest due to a voluntarily event, such as retirement, or an involuntary event, such as death, disability, insanity, or bankruptcy. It also affords the co-owners or the business entity the ability to maintain the option or mandatory obligation to purchase the interest from an existing owner in order to restrict outsiders or undesirable business partners from becoming owners. This is often a useful provision for family businesses.

Living Trusts

Having a legal document that details what should happen to your assets upon your demise is a vital part of estate planning. One way to make sure that your final wishes are met is to create a living trust. There are three distinct benefits of creating a living trust; avoiding probate, saving money and maintaining the privacy of your estate.

Probate Administration

Administering the estate of a person transferring their assets with a will or those dying without estate planning documents has benefits but the process is complicated and time consuming. We can help you understand your choices.

Long Term Care & Medi-cal Planning

Most individuals and families want Medi-Cal to pay for long-term care or the preparation of the need for a skilled nursing facility (SNF), sub-acute facility or rehabilitation center. Medi-Cal is the only government program that will cover the cost of long-term care in a skilled care facility. The process of Medi-Cal planning is to properly protect the financial integrity of the individual(s) while getting them the benefits they currently need or might need in the future.

Trust Administration

We can help you gather trust assets and distribute the assets efficiently.

Inheritance Equalization

Many issues can arise if your business is distributed equally to active and inactive children in the business. If you want the business to continue after you’re gone, and if you want your kids to succeed in their chosen professions (whether it’s the family business or not), it is imperative you take the time now to equalize their inheritance in a logical manner.

Comprehensive Estate Planning

Every person needs an estate plan but the complexity of the plan depends on the specific circumstances. Some individuals may need limited documents to transfer their personal property to their loved ones. Others may need living trusts and even other business entities. Whatever your situation, we can help you plan for the orderly and efficient transfer of your legacy.

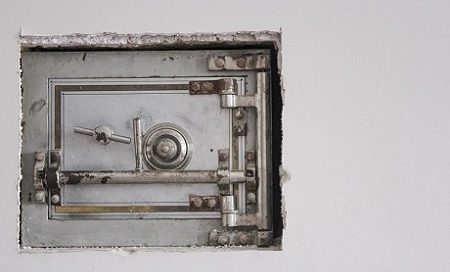

Asset Protection

Things you can do will effectively provide asset protection before a claim or liability arises, but few things will afterwards. We can help you limit liability in a litigious and high divorce rate world .

🔐📑 Proactive POA Planning: Empowering Agents & Protecting Your Financial Future 🏦✅

When it comes to planning for future incapacity, a properly executed Power of Attorney (POA) is an essential legal instrument. It allows designated agents to

🧑⚕️💰 Medicare Decision Tree: Social Security & HSA Implications Explained 🏥💳

Medicare Decision Tree: Social Security and HSA Implications Introduction As individuals approach age 65, decisions regarding Medicare, Social Security, and Health Savings Accounts (HSAs) become

❤️🩹⚖️ Guiding Clients After a Loved One’s Passing: A California Attorney’s Perspective

As both an attorney and financial advisor practicing in California, I’ve guided numerous families through the trying process that follows the loss of a spouse

💸 Understanding How Social Security Is Taxed (And Why It Matters) 💰

Understanding How Social Security Is Taxed (And Why It Matters) If you’ve started exploring your retirement income strategy—or if you’re actively receiving Social Security—there’s

💼📈 Understanding Required Minimum Distributions (RMDs) and Strategies for Managing Them

Understanding Required Minimum Distributions (RMDs) and Strategies for Managing Them Introduction After decades of saving in tax-deferred retirement accounts, it can be surprising—and sometimes stressful—to

📜🏠 Estate Planning: It’s Not Just for the Wealthy

Estate Planning: It’s Not Just for the Wealthy Estate planning often carries the misconception that only millionaires or those with extensive property holdings need it.

“Great things are not done by impulse, but by a series of small things brought together.” ― Vincent Van Gogh

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus ullamcorpe pulvinar.

Why Veracruz Law

Choosing a law firm to handle the well-being future of your family can be one of the most important decisions you can make. If you feel that professional step by step attorney advice, as well as family-like support, is important, then we at Veracruz Law welcome the opportunity to serve you and your family.

We are proud and experienced industry leaders in Medi-Cal Planning, Estate Planning, Trust Administration, and Probate. With over 20 years of experience, our large legal team is fully capable of handling your needs. We believe that our representation is the best investment you will ever make, but also understand that great results do not require a great expense.

Your convenience is also important to us. Don’t have time to come into an office? We can provide a FREE consultation over the phone. The minimum you will receive is an hours’ worth of legal education.