What’s a Will and What Does It Do?

A last will and testament is an instrument that controls how your estate is to be probated after your death.

1) Your estate is everything you own that is titled solely in your name at your death.

2) Probate is a Court process to administer estates.

A will only controls your estate and an individual can easily avoid probate by not titling assets solely in one’s name. For example, joint bank accounts, retirement plans or insurance policies with beneficiary designations, residences transferred to a trust are not controlled by your will and do not go through probate. Moreover, the titling of the asset overrides anything that may be said in a will.

Most people associate negatively with Probate so why would anyone want to go through it?

The main reason is that people don’t want probate but they simply do not know what happens to their assets when they die. Tragically, many individuals fail to properly plan and their families are forced to scramble and go through what can be a very complicated process at a difficult time.

But other individuals do consciously determine to have substantial estate assets be distributed through probate because it is public and the Court provide oversight services. These individuals are often wealthy who can afford the time and expense of the process.

There are also simplified probate procedures for small estates and also to confirm a spouse right to community property.

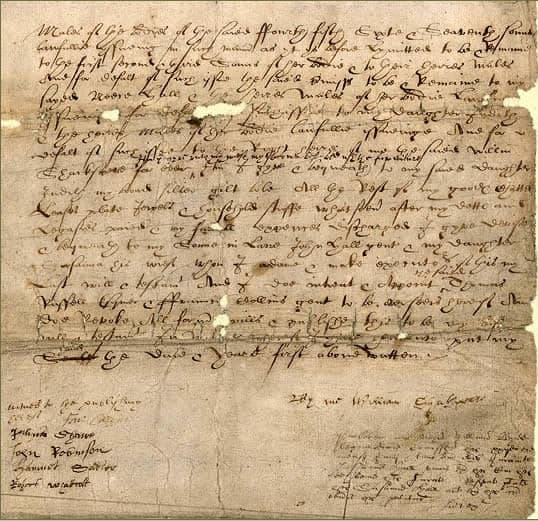

Under California law, any person over the age of 18 and with “testamentary capacity” (of sound mind) can draft their own will. The California Probate Code (the law for estates) makes only a few requirements for a valid will.

- The will must be signed by the testator (person who the will belongs to) OR in his or her name by another under the testator’s direction and also in the testator’s presence, OR by a conservator with a court order;

- The signing of the will (or the acknowledgement of the signing by the testator) must be witnessed and signed by at least two people at the same time. These two people must also understand that they are signing the will of the testator.

Note: A will may still be valid if these three things are not done, but this becomes more complicated and requires “clear and convincing evidence” to be presented before the court. (CA Probate code 6111).

Under California law, any person over the age of 18 and with “testamentary capacity” (of sound mind) can draft their own will. The California Probate Code (the law for estates) makes only a few requirements for a valid will.

- The will must be signed by the testator (person who the will belongs to) OR in his or her name by another under the testator’s direction and also in the testator’s presence, OR by a conservator with a court order;

- The signing of the will (or the acknowledgement of the signing by the testator) must be witnessed and signed by at least two people at the same time. These two people must also understand that they are signing the will of the testator.

Note: A will may still be valid if these three things are not done, but this becomes more complicated and requires “clear and convincing evidence” to be presented before the court. (CA Probate code 6111).

What is the cost to Probate an Estate?

The first thing to note is that many assets do not require a probate proceeding to be transferred to a beneficiary or heir. For example, beneficiaries designations on life insurance proceeds or retirement account do not require a probate petition.

There are also simplified processes for smaller sized estates and also to confirm rights to spousal community property.

All costs are not derived from your own account, but from the proceeds of the deceased. “Letters testamentary” and “court orders” are used by the representative to gain access to the deceased account.

The breakdown of fees are provided for informational purposes only and can vary considerably from one estate to another.

Probate Fees

Court Filing fees are $435.00 for each petition filed. Generally, only two petitions are required (1) Petition to probate and (2) Petition for Final Distribution

Appraisal Fees are ypically .1% of the value of the appraised asset

Publication fee: $100-200.00

Certified Copies: $100.00

Misc.: $100.0

Executor Fees are equal to the statutory attorney fees unless the executor elects to waive these fees.

Attorneys are paid statutory fees according to law and can also be compensated for “extraordinary fees”. Extraordinary fees need to be approved and are dependent on the complexity of the estate and value of the work provided to the estate by the attorney. The statutory fee is based on the following schedule:

4% of the first $100,000.00

3% of the next $100,000.00

2% of the next $800,000.00

1% of the next $9,000,000.00

.5% of the next $15,000.00

Above $25,000,000.00, court will determine

https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?sectionNum=10810.&lawCode=PROB

Normally in the state of California, it can take between 12 months to 2+ years depending on the circumstance.

Submit the form below and you can receive a FREE ONE HOUR STRATEGY ESTATE PLANNING STRATEGY SESSION.

We can help you get through the probate process or develop an estate plan that avoids it.